Buyer Says One Thing, Bank Says Another - Who's Correct?

You've probably found yourself wondering why the same property can be valued so differently - but what if it actually has more than one source? One direct from the bank, one obtained by the buyer, and one provided by your agent or professional appraisers. And the real kicker? None of them agree.

Whether you're planning to buy, sell, refinance, or simply curious about your net worth, understanding why your property carries different price tags isn't just useful - it's essential. Because in today's fast-moving market, the price someone is willing to pay isn't always the same as the price a bank is willing to back. Hence it is so important to know the process if this happens to you!

Stick around - the answers could save you thousands, or at least a major headache.

Property valuation is just a fancy term for figuring out how much your property is worth - not to you, but to someone else who might buy it, finance it, or insure it. And typically, that someone else is a bank, buyer, or licensed valuer.

But here's where it gets interesting: there isn't just one kind of valuation. In fact, there are two main categories - and they work very differently.

Fair Market Indicative Value

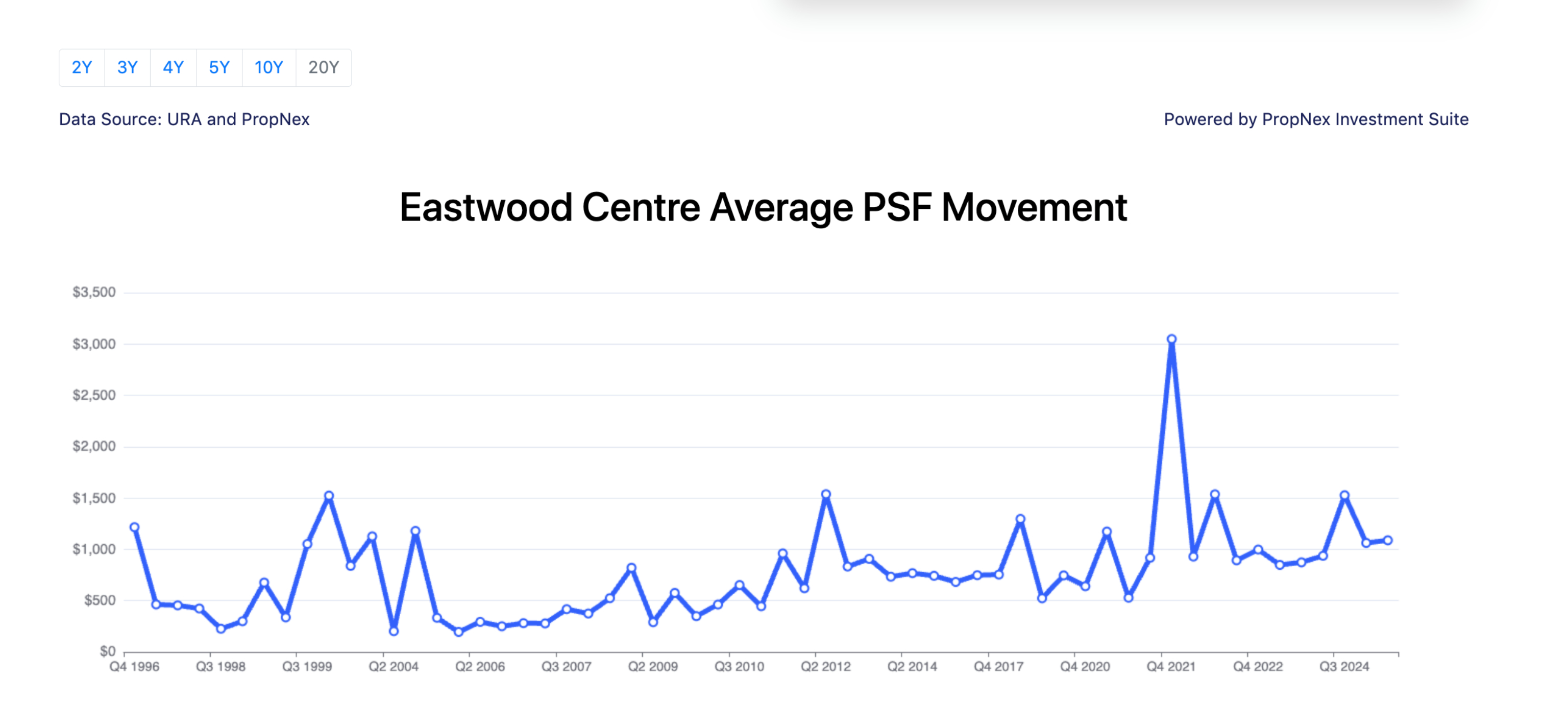

Think of this as a rough estimate - the kind you might receive from an online valuation tool or from a bank through its panel of licensed valuers, often used for purposes like In-Principle Approvals (IPA) or refinancing. These valuations are typically derived from recent transaction data and neighbourhood trends. While they're useful for gauging a general price range, they may not always capture specific unit-level nuances, such as floor height, renovations, or views - which are better assessed through a formal valuation.

You can do an indicative valuation yourself using free online calculators or historical price data. Great for curiosity. Not so great for official paperwork.

Actual valuations

These are the real deal. Ordered by banks, legal professionals, or serious buyers, actual valuations are carried out by certified valuers who consider all sorts of quantifiable details - the unit's orientation, condition, floor level, renovation quality, and more. They even step inside the property, unless they are BUC properties.

And yes, this indicative figure is often what your bank refers to when assessing your home loan - but not always. Depending on market conditions and the bank's internal risk appetite, the valuation used could be more conservative than expected. So if you've ever been surprised by a valuation that came in lower than what you were hoping for, it's usually because the bank is managing its exposure - especially in uncertain or volatile markets. It's not just about recent sales; it's also about how much risk they're willing to take on.

Don't confuse an agent's ballpark with an actual valuation. Only the latter makes it to the bank's calculator. Then again, if your agent were equipped with the most cutting-edge tech tools with real-time data then such discrepancies are much rarer.

That's why appointing the right agent is critical - not just in determining a competitive market price, but also in guiding you through the process with data-backed accuracy. Agents from agencies without proper technological tools or access to real-time market analytics are far more likely to provide broad "ballpark" estimates, which may miss the mark. In contrast, well-equipped agents can leverage up-to-date transaction data, project-specific trends, and pricing tools to give you a sharper, more reliable valuation.

Let's break down the most common types of property valuations and how they're used:

1. Bank valuation of property

This is the number your bank cares about - and no, they're probably not throwing that kind of cash at you anytime soon. Rather, it's used to determine how much they're willing to lend you for your mortgage. It's usually on the conservative side, that being said, during good economic times their valuation could be seemingly optimistic too.

2. Independent property valuation

This is a formal, unbiased valuation conducted by a licensed valuer - typically used when there's something significant at stake, such as a legal dispute, divorce, or inheritance. But it's not limited to such scenarios. Some property owners, especially those with landed, commercial, or industrial assets, choose to pay for a formal valuation to get a clear, professional assessment of their property's worth before selling. It's detailed, highly credible, and often holds weight in legal and financial settings.

3. Automated property valuation (APV)

AVMs use advanced algorithms to crunch large datasets - including past transactions, nearby property prices, and market trends - to estimate a property's value. They're fast, often free, and great for getting a general sense of what a property might be worth. But don't expect any nuance. AVMs cannot replace actual property valuers, and can't tell if you've just splurged on a brand-new kitchen or knocked down a wall to create an open-concept layout. They work best as a starting point, not the final word.

4. Agent's Analysis / Comparative Market Analysis (CMA)

Your agent can provide a CMA based on recent sales in the area. It's especially helpful for sellers looking to set a competitive price. While it isn't a formal valuation, it's important to note that CMA is also the foundational method professional valuers use when determining a property's value.

At PropNex, our agents go beyond the basics. Armed with Investment Suite - a powerful, proprietary app - they gain access to real-time transaction data, project-specific insights, and analytical tools all in one platform. This means they can produce sharper, data-backed recommendations in seconds - often using up-to-the minute data not yet available to the public or even licensed valuers. It's more than just a rough estimate; it's smart, precise property intelligence at your fingertips.

Valuation fees in Singapore can vary widely depending on the type of property and valuation method used. For private residential properties, there is no such thing as one price fits all. Valuation fees are pegged to values and hence they commensurate with the types of properties that are being valued, so the higher the value and the bigger the liability the more costly the report's going to be.

But just for your benefit, our valuation team generally value private apartments/condominiums starting from around $400, to upwards of $1,000. And as an example, a terrace house will cost about $900 to $1,000, the value goes up for bigger types of landed properties. To get a better idea of how much your home valuation would cost, you should hit them up for a chat - that part, it free-of-charge.

Most private property owners rely on their agents to link them up with a licensed valuer or surveyor However, you can also engage yourself directly from the Singapore Institute of Surveyors and Valuers (SISV). Reputable real estate companies, such as PropNex also offer valuation services for private properties.

If you're purchasing a HDB flat, the process works a little differently. You'll need to obtain a valuation report directly from HDB, which costs $120, depending on the type of flat. This valuation can only be requested by the buyer after obtaining the Option to Purchase (OTP), and must be carried out by a valuer on HDB approved panel. Sellers are not permitted to request an HDB valuation report.

Psst... this reminds me - check out these 6 common and costly OTP mistakes that many Singaporeans make. You'll want to avoid them too!

Whether you're Googling home appraisal cost or questioning the house appraisal cost for a particular flat or condo, always confirm what the valuation cost of property includes - and who's footing the bill. Some valuations are free (especially AVMs), while others are more comprehensive and come with a fee. Some valuations are complimentary, but others can cost you a couple of hundreds.

So, why does one property have multiple values?

Banks may play it safe with conservative valuations, but when times are good could provide optimistic valuation.

Buyers and sellers may obtain different valuation due to different risk assessments by the bank. There are several factors in determining.

AVMs and desktop valuations rely on data, not on-the-ground context.

Independent valuers do deep dives, which can lead to very different figures.

These valuation gaps can affect your home loan amount, negotiating power, and even your buying decision - especially if you're not prepared for how the numbers can shift.

For buyers, the valuation process has three major implications:

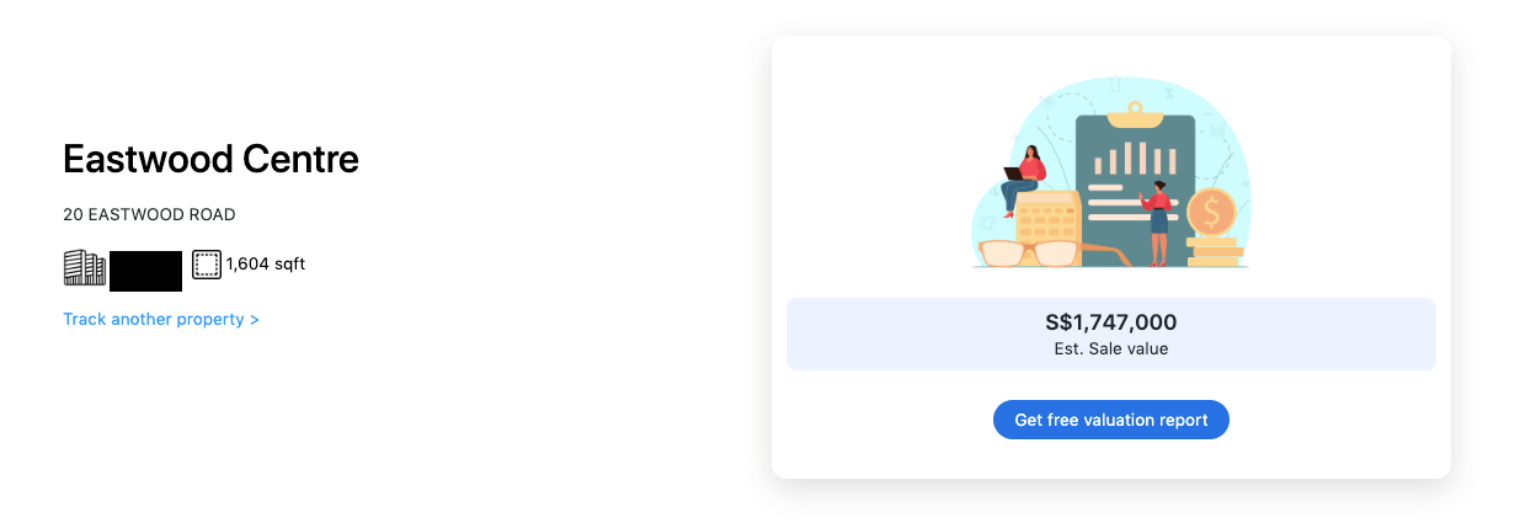

It affects your loan quantum. Your maximum loan amount is based on the lower of the purchase price or the property valuation. So, if you're buying a home priced at $1.7 million but the valuation comes in at $1.68 million, the bank will only lend (up to 75%) based on the $1.68 million. This means more cash upfront from you. A lower valuation translates to a smaller loan and a bigger down payment.

Higher valuations mean more taxes. Taxes like BSD and ABSD are calculated based on the higher of the purchase price or valuation. So, even if you negotiate a great deal, a higher valuation could still mean more taxes payable.

You may want to reconsider the purchase. If the valuation is significantly lower than the asking price, it might be a sign to pause and re-evaluate whether the property is worth the premium - or whether it's better to keep looking.

All of this just proves that knowing a property's valuation isn't just a formality - it could make or break your budget.

The truth is, they're all correct - in their own way. The key lies in understanding the context behind each valuation:

Buying with a mortgage? The bank's valuation matters most since it determines your maximum loan.

Selling your home? Trust your agent's CMA or get an independent professional appraisal to set a competitive asking price.

Considering an investment? Quick tools like AVMs or desktop valuations are useful starting points, but dive deeper for high-stakes decisions.

Each valuation method has its own purpose - knowing which one to lean on can save you from costly mistakes.

So, what exactly is your home worth? It truly depends on who you're asking and why you're asking.

Valuations aren't just numbers pulled out of thin air - they're useful financial tools that influence everything from pricing and loan eligibility to sale negotiations. But at the end of the day, numbers are still just numbers. You could have a home priced attractively on paper, but if it doesn't resonate with someone, it's like trying to sell ice to an Eskimo. That's why it's crucial to pair valuation figures with an understanding of buyer sentiment, unique property attributes, and market dynamics - because no single price tag tells the full story.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.